Insights

Convenience Store Midwest Showdown CONTINUES!

A new year is well underway and the convenience store competition in the Midwest continues to make weekly news.

Last year we dove into the Columbus market to see what impact a new entrant could have on a market with a strong mix of national and regional players – but one that had not experienced any significant store growth in recent years. In essence, the Columbus market was as close to a controlled experiment as you might find in retailing. And it would serve as a leading indicator of what may play out in other markets across the country as some best-in-class convenience operators execute their expansion plans. Now that we have another year of data to analyze, let’s see where things stand.

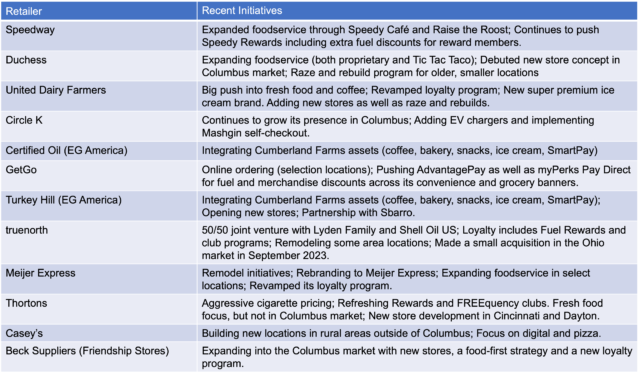

Share of Visits Continues to Shift

In 2023, share of visits continued to shift markedly in favor of Sheetz, but share gains were also had by Duchess, Kroger, Meijer and TrueNorth. Since 2019, Sheetz, Kroger, and TrueNorth are the only chains to gain share of visits in the Columbus market. Those share gains have primarily come at the expense of Speedway and Turkey Hill (EG America).

Our analysis and field visits indicate the aforementioned store count stagnation ended in 2022. Nine of the 12 convenience chains we covered in our analysis ramped up their store development efforts in 2023, ending the year with net gains in total market store count. The other three chains held steady, yet still opened new stores or remodeled some existing stores in Columbus.

Source: Company reports and Impact 21

The Best Is Yet to Come

Share of visits has shifted dramatically since Sheetz entered the market in 2021. With more stores on the way from both new entrants and incumbents, the Columbus market has not yet reached a point where we can say the competitive balance has reached equilibrium. Sheetz continues to open new stores. RaceTrac has not yet opened its first store. And as we saw in 2023, most of the incumbents are adding stores.

Revisiting the Playbook

As this disruption has transpired, we’ve seen a notable uptick in convenience retailers revisiting customer engagement, foodservice, and customer facing technology as they look to strengthen their customer relationships and drive traffic.

While you plan for expansion or look to fend off competitive encroachment, be sure to include each of these items in your playbook. Jump to the details that these actions entail in the original article below.

1. Take a Macro View

2. Portfolio Review

3. Expand Your Horizons

4. Elevate Your Strategy

5. Optimize Your Site Development Process

6. Consider Land Banking

7. Revisit Your Supply Chain Strategy

Coming Soon to a Market Near You

Of course, Columbus is just a microcosm. In other Midwest markets including Cincinnati, Detroit, and Indianapolis, the party is just getting started. The same can be said for other regions across the country. Market and regional level dynamics will play out over many years, which means retailers need to be regularly revisiting their playbook to make sure their strategies are sound, performance is measured, and adjustments are made.

::::::

Original article published November 9, 2023:

Cooler weather is starting to prevail in the Midwest, but competition in the convenience store channel continues to heat up in key markets.

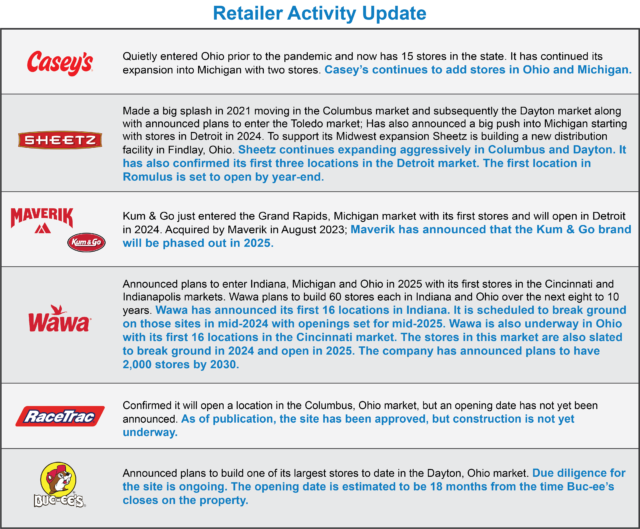

Major players including Casey’s, Sheetz, Kum & Go, RaceTrac, and Wawa have entered, expanded, or announced plans to open stores in key Midwest markets including Indiana, Michigan, and Ohio. And now Buc-ee’s wants to get in on the action with the announcement of its first store in Ohio.

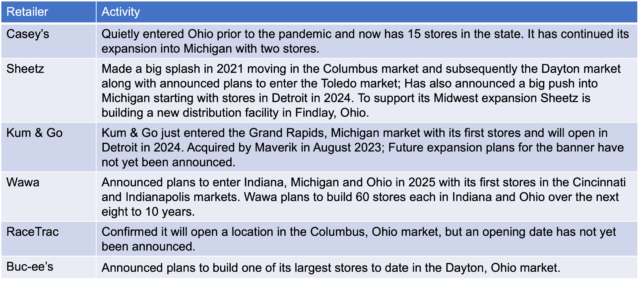

Source: Company reports and Impact 21

Source: Company reports and Impact 21

The entry of these best-in-class convenience operators will have a significant impact on the Midwest. Each player has a strong value proposition and significant growth plans. So, where is all of the fuel, merchandise, and food volume going to go?

Let’s take a look at the Columbus, Ohio market as a proxy. Sheetz’s entry into the market in 2021 included a significant number of new stores in a short time period with relatively few other new convenience store openings.

Columbus – The Incumbents

Prior to Sheetz’s entry, the broader Columbus market was already a veritable “who’s who” of convenience stores with a solid mix of national and regional players including Speedway, EG/Turkey Hill, Englefield Oil/Duchess, Circle K, United Dairy Farmers, truenorth and GetGo all with a notable presence in the market. Each of these players continue to push forth with their own strategies and initiatives.

Columbus – What Can We Learn

The incumbents have all been duking it out with each other for years. They have a large installed base of stores and generally strong locations. However, some of these locations may no longer be generating the traffic that they once did due to population migration, demographic changes and shifting mobility patterns. Plus, given their time in market many of the stores are in need of a refresh.

With similar dynamics soon to play out in other markets, expect incumbents to take another look at their remodel plans and look to redirect capital to the markets and locations deemed most worthy of protecting.

The growth of the Columbus market has provided new site location opportunities for convenience stores as development abounds and communities spread. However, consolidation in other channels including drug stores, quick serve and fast casual restaurants is both an opportunity and a threat. The closing of these locations has left seemingly “protected” incumbent convenience locations vulnerable and has opened the door for Sheetz and other entrants to grab high traffic locations in key areas.

As we can see from the data, even in just two years, there have been notable shifts in share of visits. Sheetz entered the Columbus market with strong marketing, a benchmark Made to Order food program, and aggressive fuel pricing. The strategy is clearly working, as Sheetz has quickly moved into the Top 2 for share of trips. Its foodservice program is already resonating with consumers and redefining expectations of c-store food in the Columbus market.

As Sheetz continues to build stores and the incumbents react, share of trips will continue to be a battleground.

We can expect to see similar, but perhaps more dramatic shifts in markets including Cincinnati, Dayton, Detroit and Indianapolis where there are fewer incumbents with the market presence to retain volume against any notable store counts developed by the entrants.

While finding a new competitor across the street from your convenience store is nothing new, the Columbus market serves as an example of the immediacy of the impact and a reminder to stay on top of your game on a market-by-market basis. Portfolio assessments are an ongoing activity and should look at population growth, demographic shifts, mobility patterns and competitive encroachment.

Market Drivers

There are several dynamics that are creating these market level opportunities and challenges for convenience retailers not just in Columbus, but in key markets in the Midwest and across the country.

- Market Growth – The Columbus market has been one of the fastest growing metro areas in the US due in part to strong economic development. Population growth is expected to grow by another 30% by 2050, further adding to its appeal.

- Consumer Behavior Changes – As the Columbus market grows, the demand for housing has led to new development in established communities as well as geographic expansion in the outlying counties. With new options for goods and services, consumers have changed their shopping patterns. Pair that with hybrid work environments and other mobility changes and you have notable store traffic changes at existing stores and opportunities to build new stores in growing areas.

- Retail Dynamics – As the macro dynamics play out, we can see these changes at the local level. Consolidation in other channels including drug stores, quick serve and fast casual restaurants has led to store closings. This has opened the door for players like Sheetz to acquire prime real estate.

Action Needed

All of the disruption at hand is reinforcing the need for strategy refinement and proactive portfolio management.

- Take a Macro View – Start at the market level not only to identify where populations are growing and shrinking, but also the generational mix of those changes. Today’s store traffic challenge may be tomorrow’s gold mine.

- Portfolio Review – Take a deep dive on all stores on a regular basis for both opportunities and risks. Keep in mind that a new competitor across the street with a strong value proposition can quickly turn your cash flow machine into a headache.

- Expand Your Horizons – Sheetz was able to get prime real estate due to closures from Walgreens and a restaurant chain. Without this expanded view of both risks and opportunities you leave yourself vulnerable to encroachment or missing out on strong new site locations.

- Elevate Your Strategy – Make sure your relationship with your customer is strong. Is it time to revisit/reinforce your brand strategy? Is your loyalty program stagnant? Is your foodservice program stale? Have you reviewed your fleet program recently? Where are we most susceptible to customer leakage?

- Optimize Your Site Development Process – Review your end-to-end processes from site identification all the way through to store opening to ensure you are finding the right sites and building/remodeling as efficiently as possible.

- Consider Land Banking – This can be a great way to protect existing locations as well as acquire land for future opportunities.

- Revisit Your Supply Chain Strategy – Both incumbents and new entrants should be taking the opportunity to review their distribution model. New stores and new markets change the distribution dynamics for both the retailer and any distribution partners. As store counts grow and geographic penetration changes, recalibration may be in order.

From merger and acquisition activity to geographic expansion, the convenience channel dynamics continue to change at a rapid pace. Operators need to be increasingly proactive in understanding the changing dynamics of their existing territory as well as looking for expansion opportunities.

Source: www.morpc.org/wordpress/wp-content/uploads/2023/02/Population_Growth_Forecast_2024-50.pdf

Related Insights

Is Tesla the New Oil Major?

A Leader Amongst Followers When we hear the name Tesla, right or wrong, we immediately think about the brand that […]

Why You Need An Automation Journey Map

Investment isn’t enough. To maximize the potential of retail automation technology, companies need a deliberate approach. Most of the business […]

Convenience Store Midwest Showdown CONTINUES!

A new year is well underway and the convenience store competition in the Midwest continues to make weekly news. Last […]

Want to stay in touch? Subscribe to the Newsletter